The slow-motion decline in mortgage rates continued this week, nudging them to their lowest point of 2025 and raising a key question: Is this enough to finally awaken the long-dormant housing market?

According to data released by Freddie Mac, the average rate for a 30-year fixed mortgage fell to 6.5% this week, down from 6.56% just seven days prior. The drop was even more pronounced for 15-year loans, which now average 5.6%. It’s a noticeable shift, particularly for homebuyers who have been sidelined by the high-rate environment of the past two years. But so far, the response has been more of a whimper than a bang.

A Trickle, Not a Flood, of Buyer Demand

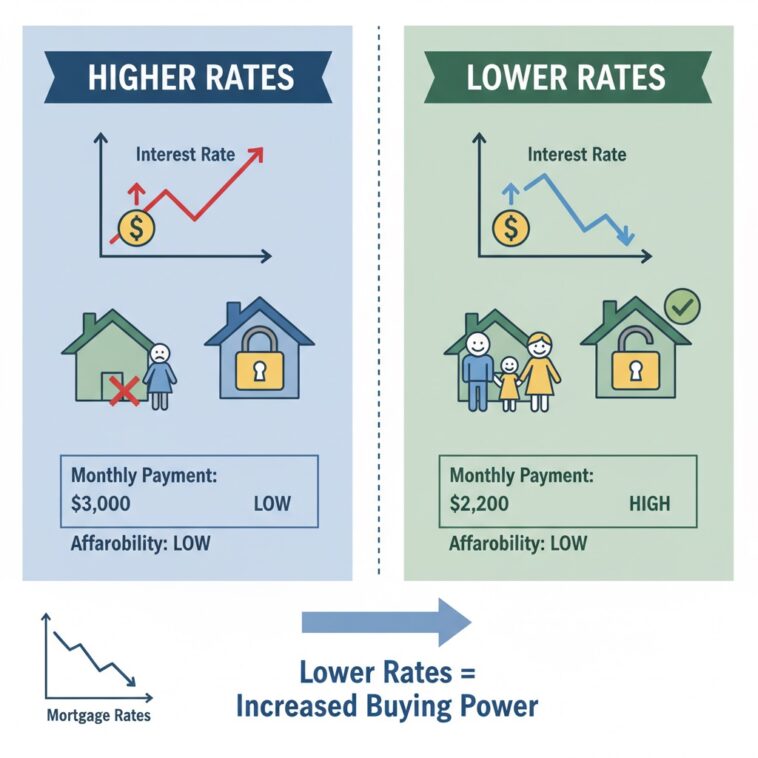

Even with rates dropping, there’s hardly any sign of a big uptick in buying activity. According to the Mortgage Bankers Association, applications for new home purchases actually fell by 3% last week. It’s a puzzling situation that underscores the ongoing affordability challenges still plaguing the market.

“This is what we refer to as a ‘trickle, not a surge,'” explained Mark Henderson, a senior housing analyst at Redfin. “While rates are heading in the right direction, the price of homes is still out of reach for many. Sure, you might save a few hundred bucks a month on your mortgage, but if the median home price is around half a million dollars, that doesn’t really change the game for most first-time buyers.”

This situation indicates that although lower rates are essential for a housing recovery, they might not be enough on their own. Home prices, which remain high in many areas, continue to be a significant barrier, dampening the positive effects of these rate changes.

The Labor Market’s Role in Mortgage Rates

The direction of interest rates is closely linked to the state of the labor market and, in turn, the Federal Reserve’s upcoming decisions. As the central bank weighs when to kick off its long-awaited rate-cutting cycle, the latest economic data becomes crucial.

Recent reports suggest a softening labor market, which could further support the downward trend in rates. In July, job openings dropped to a 10-month low, and private sector job growth last month was surprisingly sluggish.

“Signs of ongoing labor market weakness could likely strengthen the current downward trend in rates,” said Kara Ng, a senior economist at Zillow. “On the flip side, unexpectedly strong employment numbers could quickly reverse the recent progress we’ve seen.”

The monthly jobs report coming out this Friday is now the focal point. A weak report could speed up the Fed’s timeline for rate cuts, pushing bond yields—and consequently, mortgage rates—even lower. Conversely, a strong report might stir up some market volatility, potentially undoing the recent gains. It’s a waiting game, with markets on high alert for every new data release, eager for a clear signal.

Looking Ahead

Right now, the housing market feels pretty stagnant—stuck between the hope of lower interest rates and the harsh reality of high prices. While the recent dip in rates is a nice break for buyers, it’s not quite the game-changer everyone was hoping for. The next big shift in rates will probably be influenced more by the overall economic situation, especially what’s happening in the job market, rather than just housing demand. It looks like a true recovery in housing will be a slow and steady journey, marked by small wins like this one.