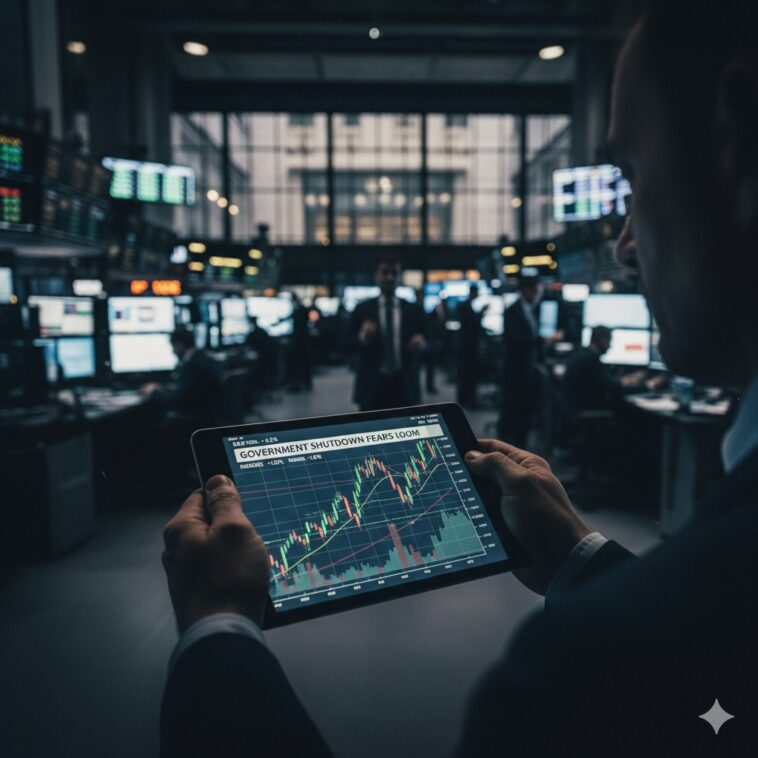

A potential government shutdown created a wave of uncertainty on Wall Street this Monday, but surprisingly, the major indexes mostly brushed off the anxiety. The S&P 500 and Nasdaq Composite managed to inch up, while the Dow Jones Industrial Average lagged behind—a familiar pattern in a market trying to regain its balance amid the political turmoil.

The trading day was a perfect example of cognitive dissonance. On one side, lawmakers were locked in a tense standoff, facing a Wednesday deadline to secure government funding. On the flip side, investors appeared almost unfazed by the drama, wagering that even a short shutdown wouldn’t put a stop to the ongoing bull market.

Markets Hold Their Breath as Shutdown Looms

The heart of the market’s worry isn’t just about the possibility of a shutdown; it’s really about what that shutdown would mean for economic data. The Department of Labor has made it clear that if funding runs out, all operations at the Bureau of Labor Statistics would come to a halt. And that’s a significant issue. The BLS is responsible for the highly anticipated monthly jobs report, along with other important inflation indicators.

“The market’s flying blind right now,” noted Sarah Chen, a senior analyst at Capital Global. “We’re losing the one piece of information—the jobs report—that the Fed needs to decide its next steps. Without it, we’re left with nothing but speculation, which can lead to some pretty volatile trading.”

The jobs data is more crucial now than ever. Last week’s mixed signals from the economy—a surprising drop in jobless claims and an upward revision in GDP growth—had already complicated the narrative that the Federal Reserve would be aggressive with interest rate cuts. With the jobs report on hold, investors are left to wonder what this all means for monetary policy.

Tech Leads the Charge, Dow Stalls

The S&P 500 saw a slight uptick of 0.2%, while the tech-heavy Nasdaq Composite really shone with a nearly 0.5% gain. On the flip side, the Dow dipped by 0.2%, reflecting a more cautious sentiment across the broader market.

The tech sector’s resilience is particularly noteworthy, showcasing the ongoing enthusiasm for AI-driven stocks. Even though there were some signs of weakness in that area last week, a fresh wave of proposed tariffs from President Trump on movies and furniture didn’t seem to put a dent in the sector’s positive outlook.

“Tech’s just built different,” remarked Mark Johnson, a portfolio manager at Atlas Wealth Management. “The long-term narrative surrounding artificial intelligence and innovation is so robust that it’s almost shielded from the daily political chatter. Right now, it’s the ultimate ‘buy the dip’ opportunity.”

Despite the mixed signals, the markets are still poised to wrap up September—and the third quarter—with solid gains. The S&P 500 has climbed 2.8% this month, with the Nasdaq not far behind at 2.9%. The Dow, while trailing, has still managed to gain 1.5%.

Now, the big question is whether this relative calm can last. A government shutdown, even a brief one, could have real repercussions beyond just delayed data. It might shake consumer confidence and slow down spending. The longer it drags on, the more likely Wall Street’s current nonchalance will give way to a heightened sense of anxiety.